San Francisco Real Estate

Market Reports

SAN FRANCISCO MARKET UPDATE | 2023 YEAR IN REVIEW

In 2023, the market grappled with significant challenges, including elevated interest rates, uncertainties in the financial markets, unfavorable media portrayals, and a noticeable scarcity of property listings in the majority of neighborhoods, resulting in a marked decrease in sales volume. The multifamily housing market witnessed a substantial decline across various key metrics since its height in 2021.

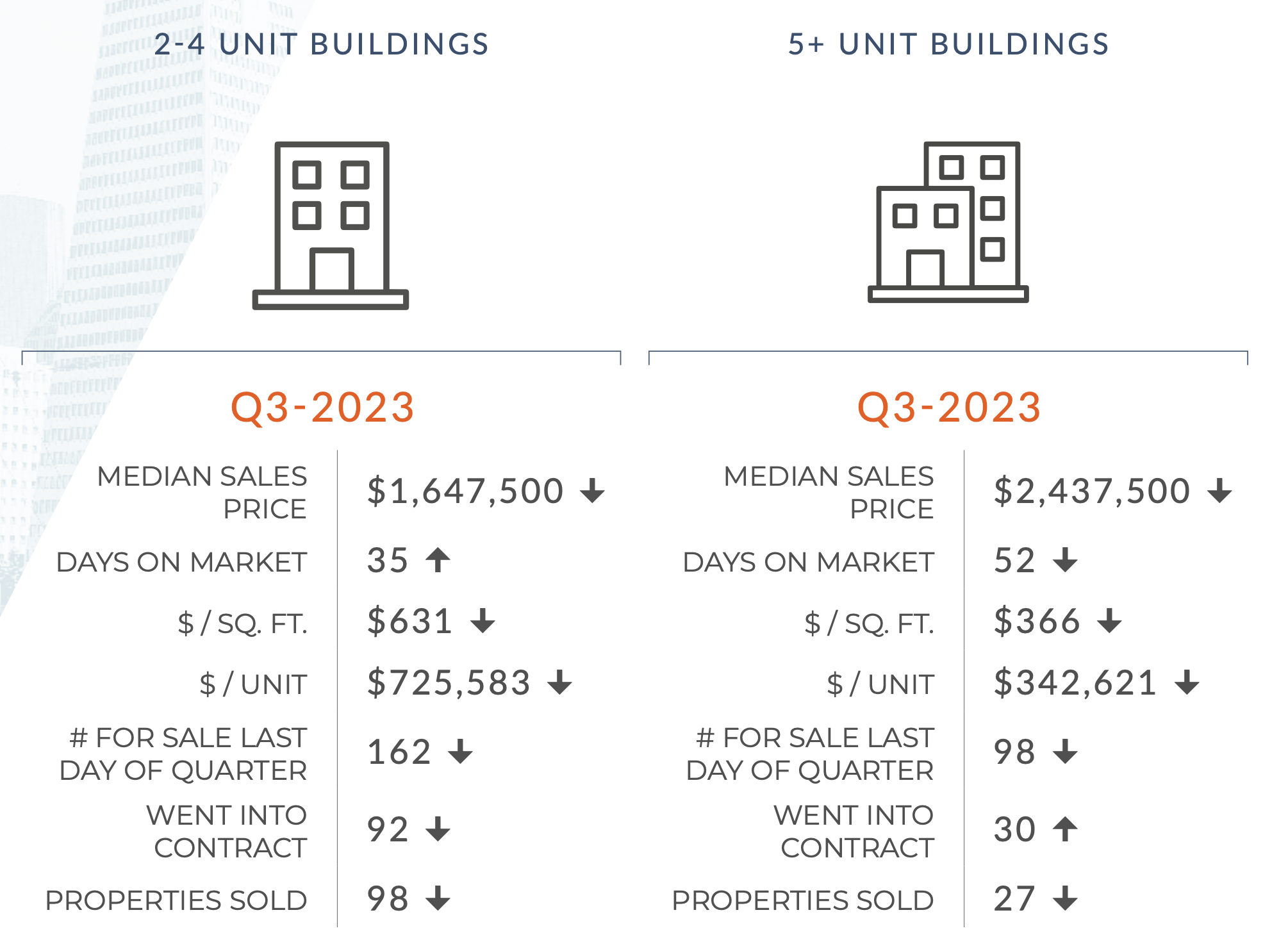

SAN FRANCISCO MARKET UPDATE | Q3 2023

It is clear that the multifamily housing market has witnessed a substantial decline across various key metrics since its height in 2021. During the third quarter, the median sales price for two-to-four unit buildings saw a notable reduction of 13.1 percent, while five-plus unit buildings experienced a 23.8 percent decrease when compared to the same period last year.

SAN FRANCISCO MARKET UPDATE | Q2 2023

Many buyers are taking advantage of the current landscape and securing deals that haven’t been seen in years. However, while the current situation seems prom- ising for buyers, fluctuating interest rates and limited inventory continue to be significant barriers in the market.

On a more positive note, rental rates in San Francisco have continued to moderately improve. Zumper.com reported an average annual gain of 3 percent.

SAN FRANCISCO MARKET UPDATE

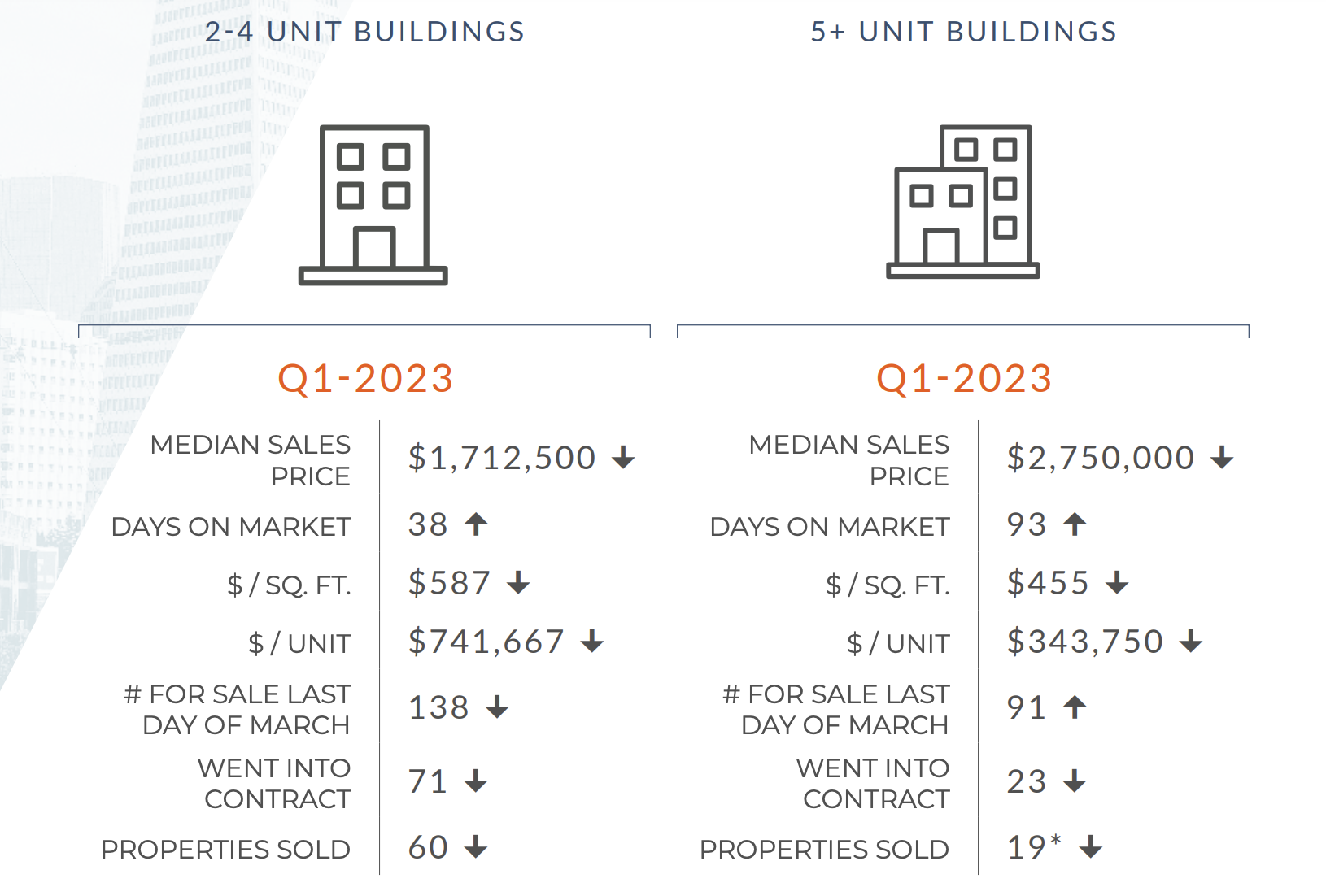

| Q1 2023

Similar to the residential market, it’s evident that the multifamily market has seen a significant decline in most key metrics compared to the unprecedented demand spike that was experienced in late 2020 and early 2021. The first quarter recorded a 16.5 percent reduced median sales price for two-to-four unit buildings and a 12.1 percent reduction for five-plus unit buildings compared to the same time last year.

SAN FRANCISCO MARKET UPDATE | 2022 YEAR IN REVIEW

Similar to the residential market, the overall trend for multifamily buildings in San Francisco was one of less competition and declining sales in 2022. The economic headwinds that arose and strengthened throughout the year had significant impacts on supply and demand.

On a more positive note, rental rates in San Francisco have continued to moderately improve. Rent.com reported an average annual gain of 3 percent for 1-bedroom apartments and a 9 per- cent jump in 2-bedroom apartments.

SAN FRANCISCO MARKET UPDATE

| Q3 2022

Similar to the overall residential market in San Francisco, the apartment building market recorded significant downtrends due to financial market uncertainty and volatility.

On the brighter side, rental rates in San Francisco have continued to moderately improve.

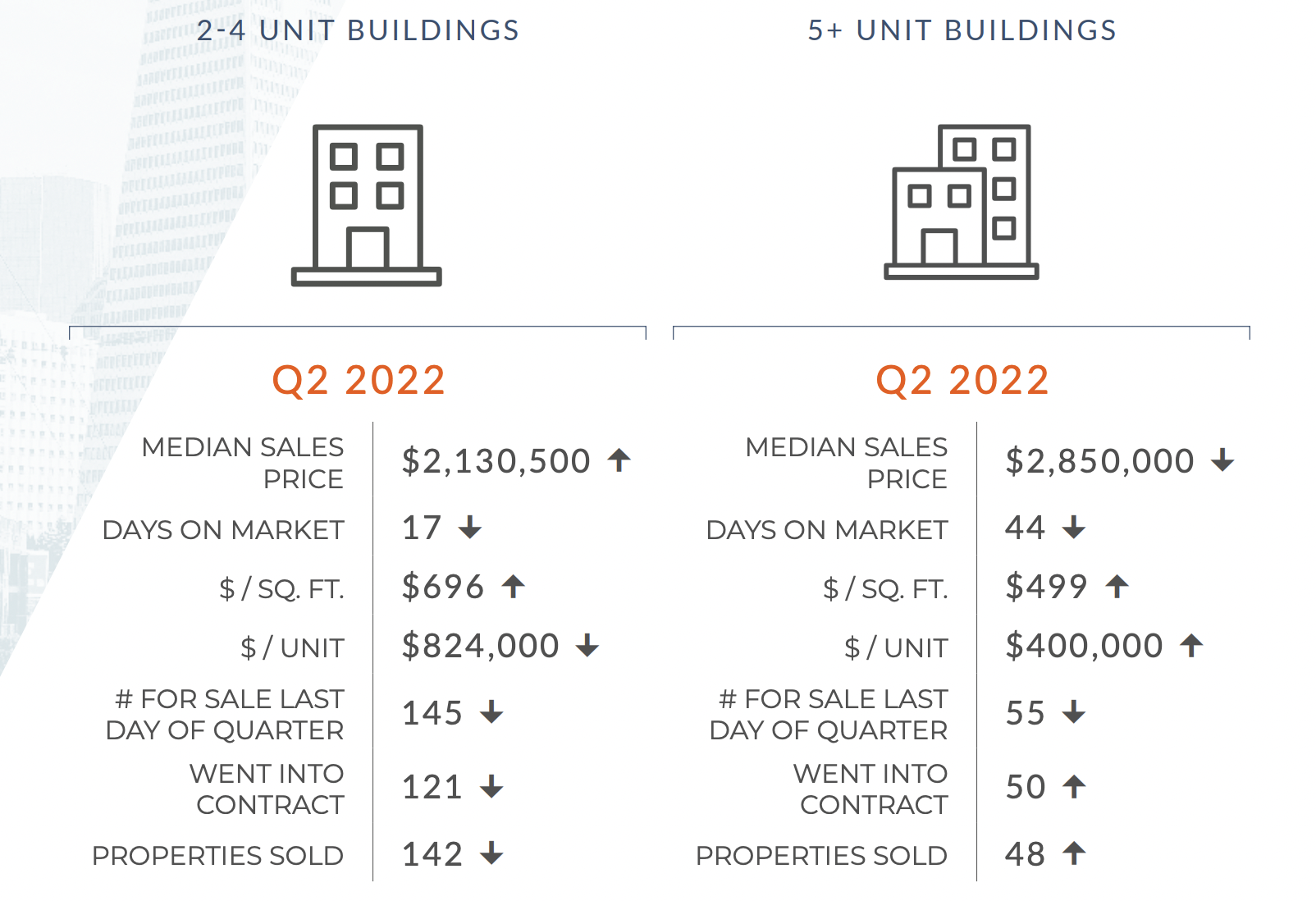

SAN FRANCISCO MARKET UPDATE | Q2 2022

With half of the year now behind us and another quarter of 2022 data available, we can see the multifamily market showings signs of increased demand leading to growth in the sector. It is important to keep in mind that this report uses data from closed sales which are lagging indicators of what occurred in the market weeks and months earlier.

SAN FRANCISCO MARKET UPDATE | Q1 2022

With Q1 now behind us and three months of activity recorded, steady growth in key metrics are emerging for the multi-family segment. Sales numbers of 2-4 unit apartment buildings are up 13.4 percent compared to Q1 of last year. The first quarter of 2022 saw gradual increases in San Francisco occupancy and rental rates, as well as employment. However, interest rates are also rising substantially.

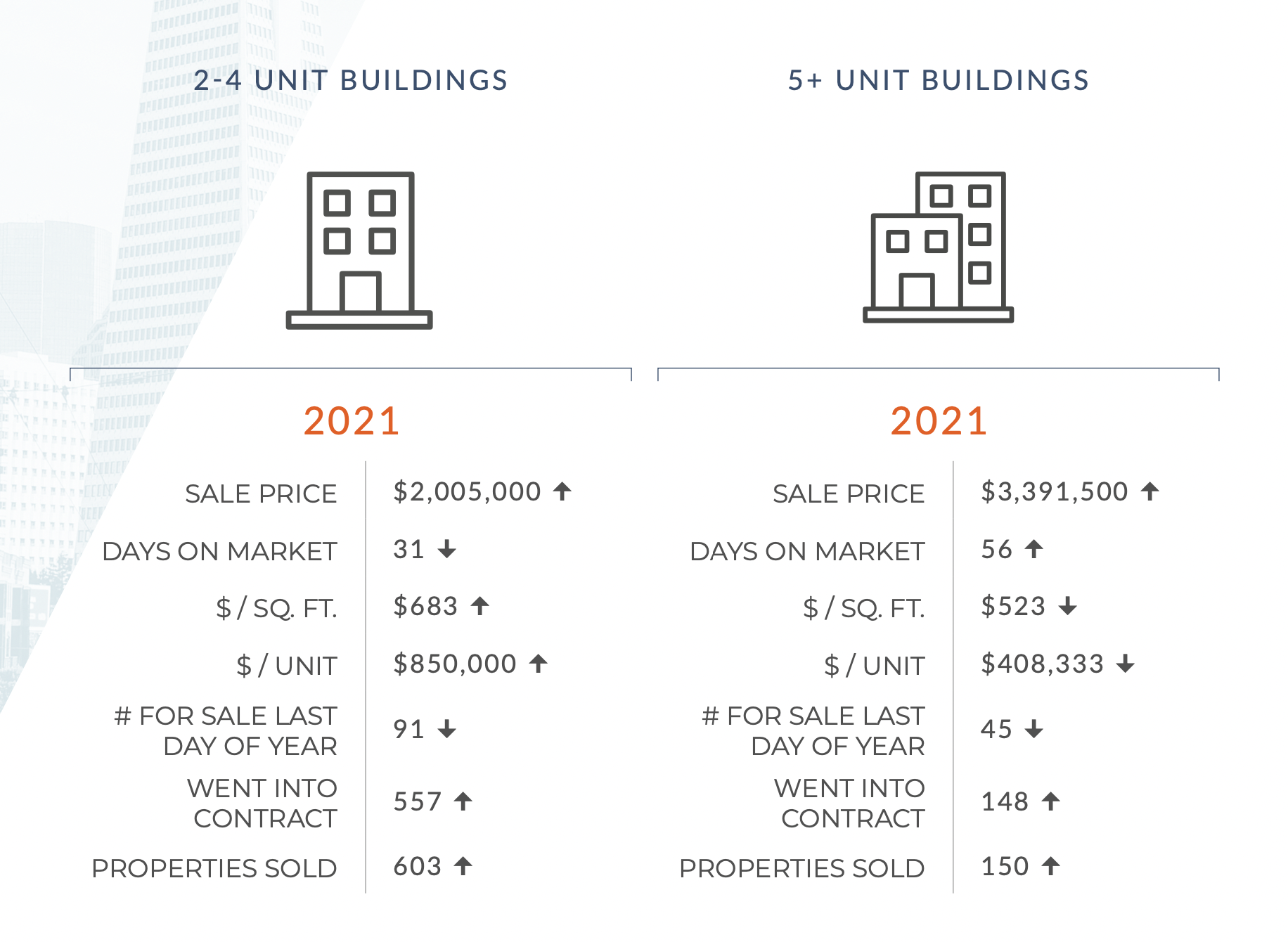

SAN FRANCISCO MARKET UPDATE | 2021 YEAR IN REVIEW

The multifamily segment of the market rebounded in 2021. Sales numbers of 2-4 unit apartment buildings are comparable to the height of the 2014 peak. The population in San Francisco has declined by about 2% since 2019, however employment numbers continued to recover in 2021. Rents also rebounded from the pandemic-induced crash, but remain significantly less than pre-pandemic levels.

SAN FRANCISCO MARKET UPDATE | Q3 2021

There was substantial growth among key metrics for the multi-unit segment of the market last quarter. Both 2-4 unit and 5+ unit buildings recorded higher numbers than last year for median sale price, price per square foot, and price per unit. Additionally, the number of recorded sales has also roughly doubled among both the 2-4 and 5+ unit sectors.

SAN FRANCISCO MARKET UPDATE | Q2 2021

The multi-family segment of the market continued to rebound during the second quarter with the waning of the pandemic. Sales numbers are up considerably across both 2-4 unit buildings and 5+

SAN FRANCISCO MARKET UPDATE | Q1 2021

One year after the pandemic brought the market to a crawl, lowered median sale prices, and significantly reduced rents; sales numbers in the multi-unit market have rebounded in Q1 and rents appear to be on their way back up as well.